Difference between revisions of "Financial Capital"

From FairShares Wiki 3.x

(Created page with "People in enterprises spend and generate money. Financial capital decreases when it is spent on acquiring resources, equipment and labour. It increases when goods/services are...") |

|||

| (2 intermediate revisions by one user not shown) | |||

| Line 1: | Line 1: | ||

| − | + | In FairShares V3.0a 'Financial capital' is renamed 'Financial wealth'. | |

| + | |||

| + | Lastly, people in enterprises spend and generate money. Financial wealth decreases when money is spent on acquiring resources, equipment and labour. It increases when goods/services are sold, or fundraising efforts are successful. This type of wealth is relatively easy to measure because accounting practices are currently based on tracking rises and falls in funding levels, changes in cash flows and the nett value of surpluses/profits from trading activities. When asked about financial wealth, think of the money used and/or generated by your enterprise/project. | ||

| + | |||

| + | |||

| + | |||

| + | [[File:V3.0-English-SixFormsOfWealth.png|600px]] | ||

| + | |||

| + | |||

------ | ------ | ||

Return to [[Capital]] | Return to [[Capital]] | ||

Latest revision as of 10:31, 11 February 2018

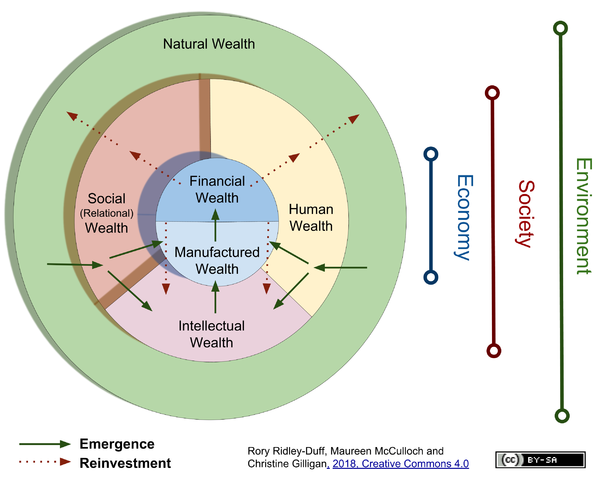

In FairShares V3.0a 'Financial capital' is renamed 'Financial wealth'.

Lastly, people in enterprises spend and generate money. Financial wealth decreases when money is spent on acquiring resources, equipment and labour. It increases when goods/services are sold, or fundraising efforts are successful. This type of wealth is relatively easy to measure because accounting practices are currently based on tracking rises and falls in funding levels, changes in cash flows and the nett value of surpluses/profits from trading activities. When asked about financial wealth, think of the money used and/or generated by your enterprise/project.

Return to Capital